Many people grow up hearing the same advice: “Go to school, get good grades, and secure a well-paying job.” This guidance often leads to the belief that this is the only way to achieve financial success. While this path may work for some, it’s not the only route to wealth. Understanding different approaches to earning money can help you find what fits best for you.

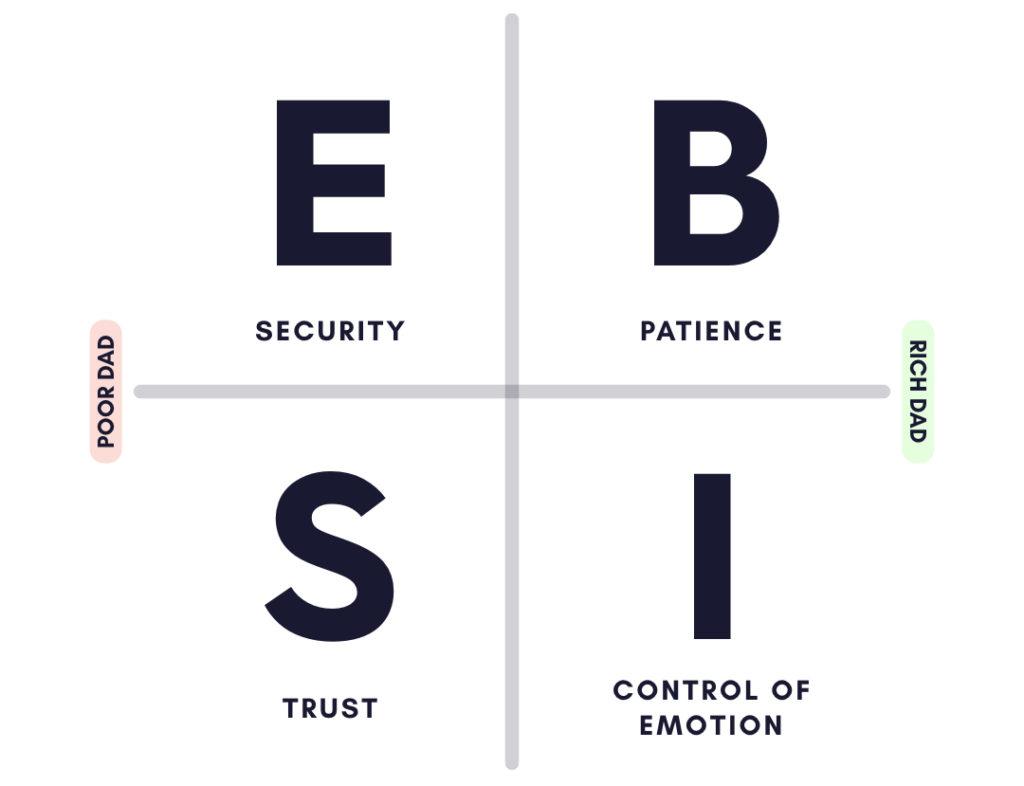

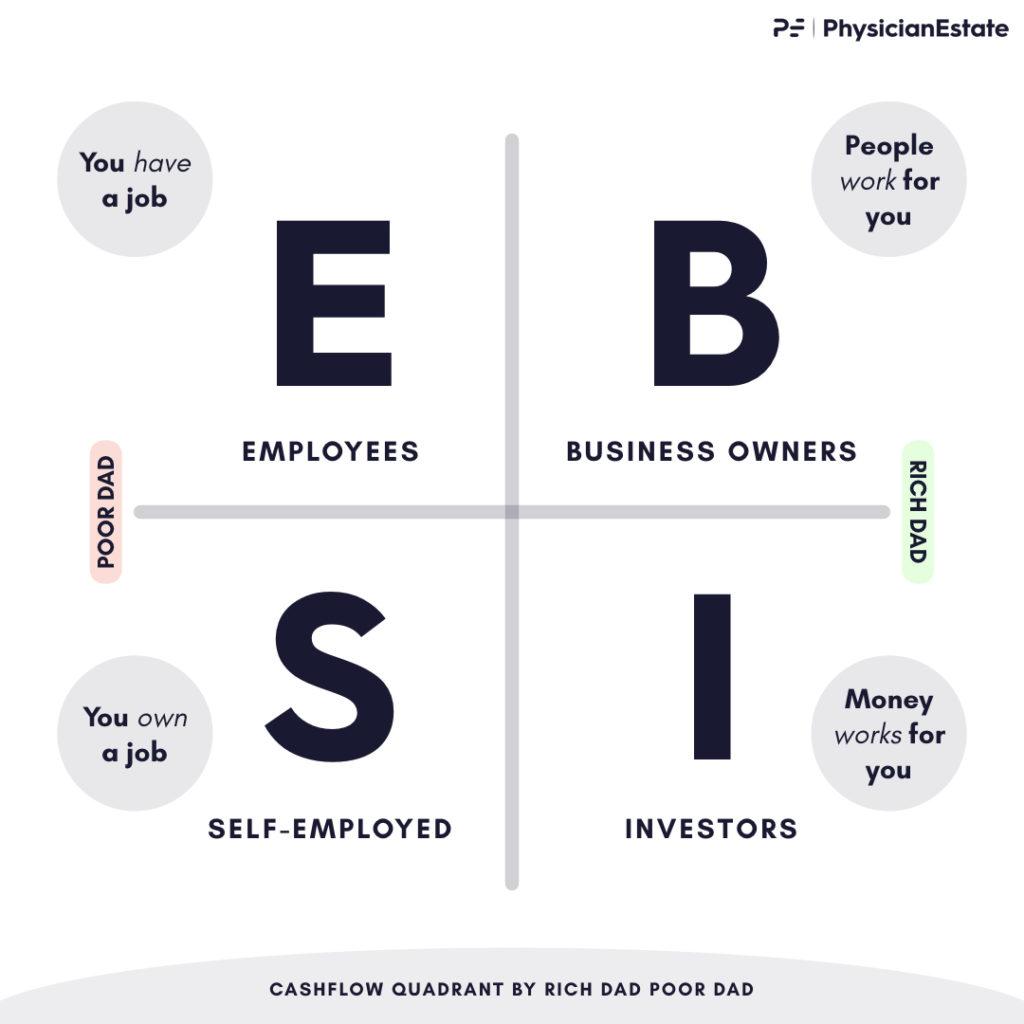

In the Cashflow Quadrant by Robert Kiyosaki, four distinct paths to financial freedom are explored. These paths include the Employee, the Small Business Owner, the Big Business Owner, and the Investor. Each quadrant presents its own advantages and challenges. By recognizing where you stand and considering the potential of other paths, you can make informed decisions about your financial future.

The Cashflow Quadrant Explained

Income Sources and Quadrant Definitions

In the Cashflow Quadrant, there are four main sources of income. Each quadrant shows a different way to build wealth based on where your money comes from:

- E – Employee: You earn a paycheck by working for someone else.

- S – Self-Employed/Small Business Owner: You work for yourself and take charge of your income.

- B – Big Business Owner: You create a business that runs with others working for you.

- I – Investor: You make money from your investments.

Employee Mindset and Goals

As an employee, your main goal is security. You aim for stable jobs with benefits. You might think, “I’m looking for a secure job that pays well and has good coworkers.” While you have certain benefits, more success often means more work and longer hours.

Small Business Owner Mindset and Challenges

If you are a small business owner, you seek control over your work life. You might say, “I want to be paid well for my skills and set my own schedule.” While this gives you independence, it can also bring financial worry and demands on your time.

Big Business Owner’s Approach to Freedom

Big business owners chase freedom, looking for ways to develop profitable systems. You might hear them say, “I need to find people who are smarter than me to help run my business.” This quadrant can lead to quick financial success, but it also requires special skills and the ability to manage others.

Investor’s Strategy for Passive Income

Investors aim for financial freedom by making their money work for them. You might think, “I need to find the best places for my money to grow.” Investors enjoy the benefits of using other people’s time and money, which often leads to less stress and the potential for significant profits.

Exploring OPT and OPM

Leveraging Other People’s Time and Money

In the quest for wealth, using other people’s time (OPT) and other people’s money (OPM) can be game changers. If you’re in the B quadrant, you can build a business system by hiring employees from the E and S quadrants and leveraging funds from those in the I quadrant. Initially, you’ll probably spend a lot of your own time getting your business off the ground, but the goal is to transition to a more passive ownership role. This is where your business can run more independently.

Limits of the E and S Quadrants

If you are in the E or S quadrants, opportunities to utilize OPT and OPM are limited. As you climb the success ladder, you may find that your workload increases. Employees often seek security in their roles, while small business owners usually aim for control over their work. This can lead to more hours worked and higher stress levels, contrasting sharply with the ways in which those in the B and I quadrants can leverage others for growth and income.

Pros and Cons of Each Quadrant

Advantages and Disadvantages for Employees

Pros:

- Job Security: Employees often have a steady income and benefits like health insurance.

- Paid Leave: Enjoy time off without losing income.

- Colleagues: Work with others which can create a sense of community.

Cons:

- Increased Workload: Success may lead to more responsibilities and less free time.

- Salary vs. Performance: You might work hard but feel your pay doesn’t match your effort.

- Dependence on Structure: Often reliant on company policies and management decisions.

Pros and Cons for Self-Employed Individuals

Pros:

- Independence: You are your own boss and set your own rules.

- Performance-Based Income: Earnings can reflect your hard work and specialization.

Cons:

- Financial Risk: Income can be unstable, depending on clients or market demand.

- More Work: Success often demands more time and effort, leading to long hours.

Benefits and Risks for Big Business Owners

Pros:

- Using Other People’s Resources: You can hire staff and use investors’ money to grow your business.

- Quick Financial Freedom: With the right business model, you can achieve significant profits.

Cons:

- Financial Instability: You could face losses if the business doesn’t perform well.

- Different Skill Set: Requires knowledge that is not typically taught in school.

- Management Responsibilities: You must oversee and manage a team effectively.

Investor’s Gains and Potential Losses

Pros:

- Passive Income: Once set up, investments can generate income without constant work.

- Other People’s Money: Leverage funds from investors to enhance profits.

- Tax Savings: Often pay lower taxes on investment gains.

Cons:

- Investment Risk: There’s always a chance of losing money.

- Market Fluctuations: Economic changes can impact your returns.

Transitioning to the Right Side of the Quadrant

Breaking the Addiction to Current Quadrant

Many people grow up thinking that getting good grades and landing a secure job is the best way to achieve financial success. This belief can create a strong attachment to the employee quadrant. If you’re used to earning a steady paycheck, switching to a different quadrant can be tough. Your mind connects your job with financial rewards, making it harder to consider options that feel riskier.

Mental Obstacles in Making the Shift

Shifting to a new financial path can be challenging due to mental barriers. You might hear thoughts like, “You are taking too many risks!” or “What if you fail?” These fears can hold you back. Additionally, our education system often rewards playing it safe. In the business and investor quadrants, making mistakes is part of the learning process. Remember, successful people have often failed numerous times before finding success, just like Thomas Edison did with his inventions.

The Role of Mistakes and Learning

Mistakes are valuable lessons when you’re moving from the employee or small business owner side to the big business owner or investor side. Taking action leads to more mistakes, but that’s how you learn and grow. It’s important to see mistakes as steps toward your goals. Surrounding yourself with successful people in the business and investment worlds can help you learn from their experiences and accelerate your journey to financial freedom.

The Five Levels of Investors

Zero-Financial Knowledge Level

At this stage, individuals have no money to invest. Their expenses often exceed their income. A common reason for this is forgetting to set aside money for savings first. This basic habit is crucial for building wealth.

The Savings-Are-Losers Level

This level involves keeping money in low-interest savings accounts or stashing it away at home. While many people might think this is safe, inflation actually reduces the value of money over time. For example, between 1980 and 2017, the value of the Swedish crown fell by 69%.

The ‘I’m-Too-Busy’ Level

Many people are caught up in their busy lives and do not have time to invest. They might give their money to someone else to handle. The downside is that such individuals miss out on learning how to manage their own investments.

Do-It-Yourself: The I’m-a-Professional Level

At this level, investors take charge of their own finances. They use their own money and make their own investment choices. They are learning about investing and aiming to improve their skills.

Capitalizing: The Capitalist Level

Investors at this level have a background in business. They know how to apply business concepts to investing. They typically work with advisors for better information and use both their own money and borrowed funds for investments. This approach helps them to manage taxes more efficiently. This level is where individuals are more likely to achieve financial freedom first.

Key Insights and Final Thoughts

You’ve likely heard the advice to go to school and get good grades for a secure job. While this path might suit many, it isn’t the only way to achieve financial success. Let’s break down the important points.

The Cashflow Quadrant

Understanding where your income comes from helps define your journey to wealth. There are four quadrants:

- E (Employee): Focuses on job security and benefits.

- S (Small Business Owner): Seeks control over income and work.

- B (Big Business Owner): Aims for financial freedom through systems and teams.

- I (Investor): Looks for ways to make money work for them.

Using Other People’s Resources

The key difference between the left and right quadrants is how you use resources. In B and I, you can leverage other people’s time (OPT) and money (OPM). This means greater potential for passive income and less personal workload compared to E and S, where you are tied to your own time and effort.

Pros and Cons of Each Quadrant

Each quadrant has its benefits and challenges:

- E:

- Pros: Job security, benefits.

- Cons: More work for more pay, limited freedom.

- S:

- Pros: Autonomy in work.

- Cons: Continuous effort and financial risks.

- B:

- Pros: Fast financial freedom, less tax burden.

- Cons: Requires special skills, financial risks.

- I:

- Pros: Passive income potential, less tax.

- Cons: Risk of losing money.

Shifting Towards Financial Freedom

Transitioning to the right side of the quadrant can be challenging due to established mindsets about work and money. Breaking free from fears of risks or failure is important. Just like Thomas Edison learned from his mistakes, taking action helps you grow.

Levels of Investors

Kiyosaki identifies five levels of investors, starting from those with little financial knowledge to the advanced capitalist level, who effectively use resources and advisors to create wealth. Understanding your current level can guide your investment journey.

Reflect on these takeaways as you think about your path to wealth. Where do you fit in the cashflow quadrant? What steps will you take to move towards financial freedom?

Lern more about intelligent Investor click here

I used image from this website: https://physicianestate.com/cashflow-quadrant-summary/

Leave a Reply